The Russia-Ukraine War and Implications for the European Defence Industry

Two years after the Russian attack on Ukraine, it is clear to everyone that the European Defence Technological and Industrial Basis (EDITB) was ill-equipped to face the consequences of a large-scale, high-intensity conflict on the Old Continent. The war changed three decades of procurement policies, production and technological trends that had previously shaped (not only) Europe’s approach to defence hardware.

From the 1990s onwards, the preference for fewer, precise, highly advanced weapon systems over the massive employment of low-medium tech solutions had a double effect on the EDITB. First, it led European markets to partially consolidate, and individual companies to strive for increased efficiency. This meant not investing/maintaining redundant production sites, divesting from relatively low profitable and low demand segments such as the manufacturing of artillery shells and pursuing research and development (R&D) investment in high-end products. Second, the emphasis on technological prowess also shaped the way the European Union tried to jumpstart defence cooperation and integration among member states, first and foremost through the European Defence Fund (EDF) and Permanent Structured Cooperation (PESCO).

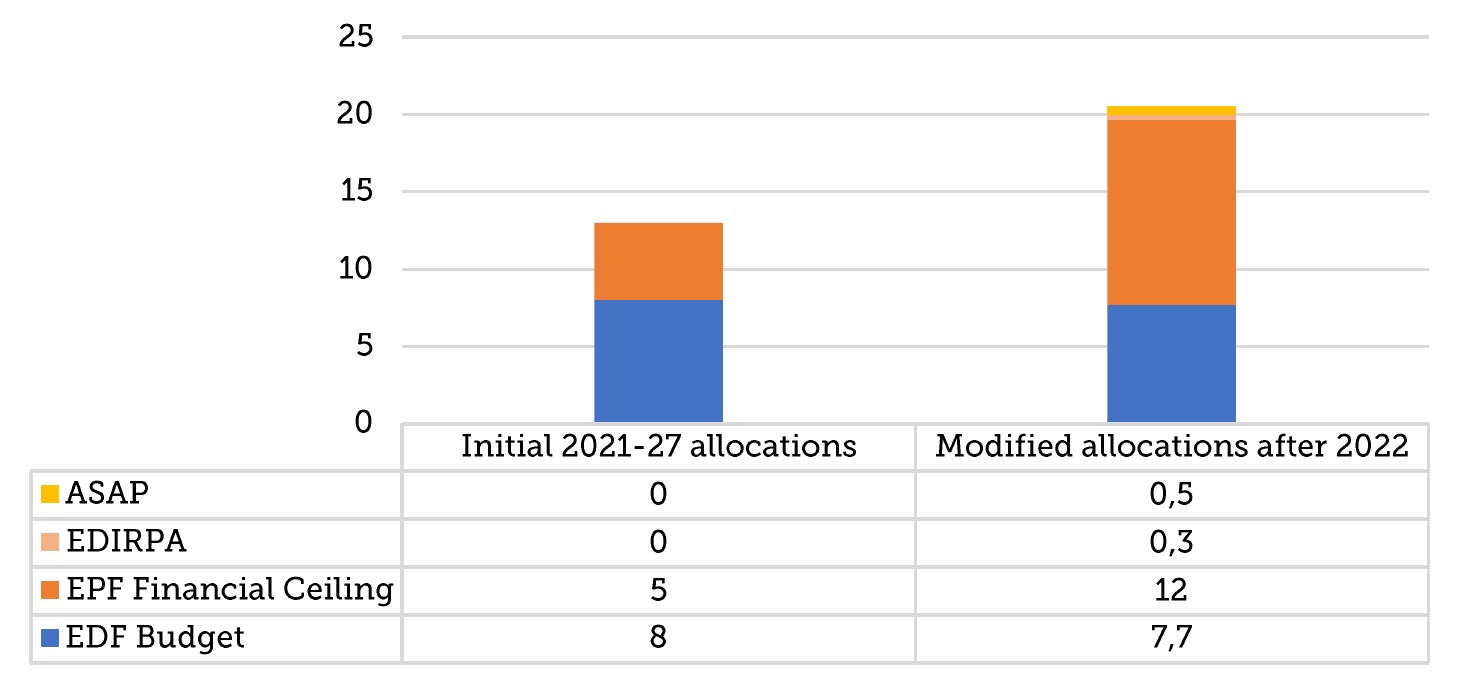

A shift to joint production and procurement

The war and Ukraine’s boundless need for ammunition, modern equipment and NATO-standard weaponry have changed the picture. The European Union has provided more than 5.6 billion euro in military aid to Ukraine by financing transfers of equipment from member states with the European Peace Facility (EPF),[1] an off-budget fund gradually increased to 12 billion euro that was rapidly repurposed as the main instrument through which Brussels backs Ukraine’s war effort (Figure 1).[2] Europe’s shallow defence stocks have, however, proven insufficient to provide enough resources to support Ukraine’s needs, particularly in the land domain. First and foremost, Ukraine’s extensive use of artillery (both 155mm rounds and missile systems) has put a significant strain on the European and transatlantic productive capacities.[3] Recognising the risks associated with uncoordinated, national responses to the surging demand for defence items, the EU has crafted new tools to guarantee military aid to Ukraine and that the replenishment of national stockpiles does not lead to crippling competition between member states on the European market, a further decrease of systems interoperability and an overreliance on non-EU suppliers and technologies.

Figure 1 | EU defence programmes (2018 prices, billion euro)

Note: the EPF Financial Ceiling is made up of national contributions, determined by the GNI.

The EDF Budget comes from the Commission’s Multiannual Financial Framework.

The first measure put forward by the EU was the so-called European Defence Industrial Reinforcement through Common Procurement Act (EDIRPA), designed to support member states in establishing joint procurement mechanisms for defence goods.[4] The earmarking of 500 million euro should have covered additional administrative and technical costs incurred when engaging in multinational procurement processes.[5] The successive political agreement axed EDIRPA’s budget to a meagre 300 million euro.[6] After almost one year of discussions, the involved parties finally found a compromise on the potential eligibility of non-EU companies and actors, thus allowing for some limited exceptions for allied countries such as the US.[7] EDIRPA should be substituted in the long term by a permanent instrument, not limited to ammunition and missiles, to be included in the European Defence Investment Programme (EDIP).

EDIRPA, which should be voted on by the EU Parliament before the 2024 elections, is a package of structural measures which required extensive negotiations and is expected to have long implementation times. As such, in 2023, the Council decided to complement the Act with a so-called “three-track approach” to boost ammunition production and immediately raise the level of support for Ukraine.[8] Track 1 consists of an invitation to member states to transfer part of their ammunition stocks to Ukraine,[9] reimbursed with funds from the EPF, while Track 2 parallelly foresees the joint procurement by member states of 1 million ammunition rounds.[10] Track 3 represents the most consistent step, and has materialised through the so-called Act in Support of Ammunition Production (ASAP), which allocates 500 million euro to financially support and boost related production capacities.[11]

Consequences for existing programmes and policies

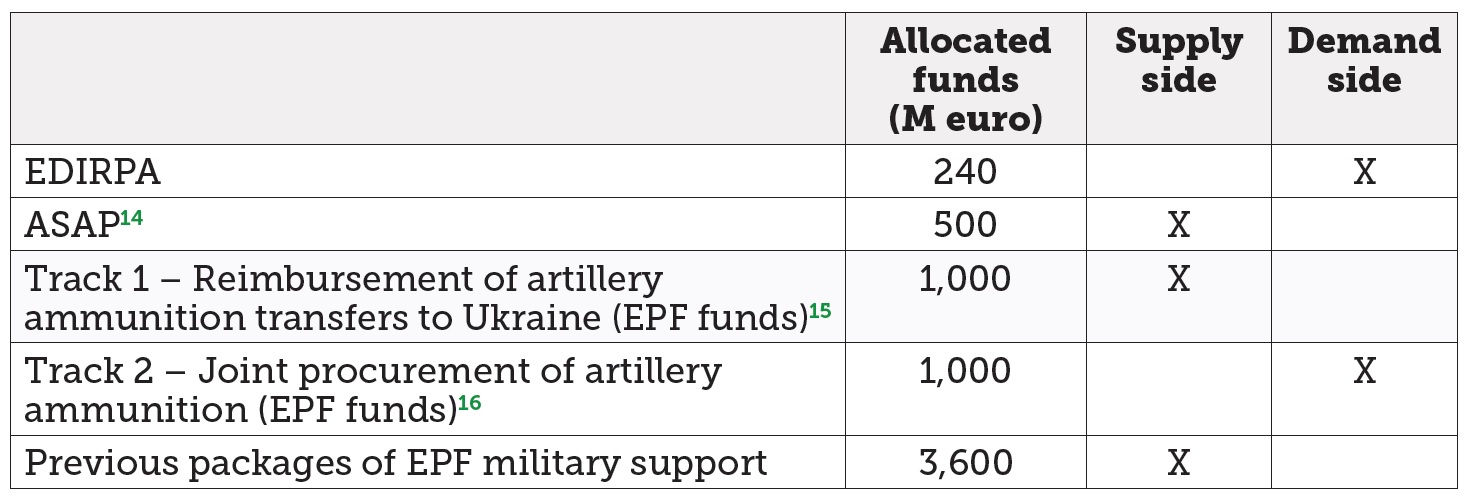

It may be too soon to talk about a shift of focus from R&D projects to joint procurement and production. First of all, it is noteworthy that most of the initiatives, and certainly the majority of allocated funds, mainly pertain to the supply side of the defence markets (Table 1). By reimbursing transfers and acting on bottlenecks and production capacities, the EU essentially tries to decrease the cost of military aid to Ukraine for member states, while only a few measures actively try to shape the overall demand for military goods (such as changing the incentives that shape procurement decisions). This may turn out to be problematic if one considers that the core issue at the heart of European defence expenditure is precisely fragmented demand.[12] Even worse, current supply-side measures are short-term and do little in terms of rationalisation and aggregation of productive capacities, as little is done to streamline value chains, optimally allocate resources and foster economies of scale.[13]

Table 1 | EU measures to boost defence production after 24 February 2022

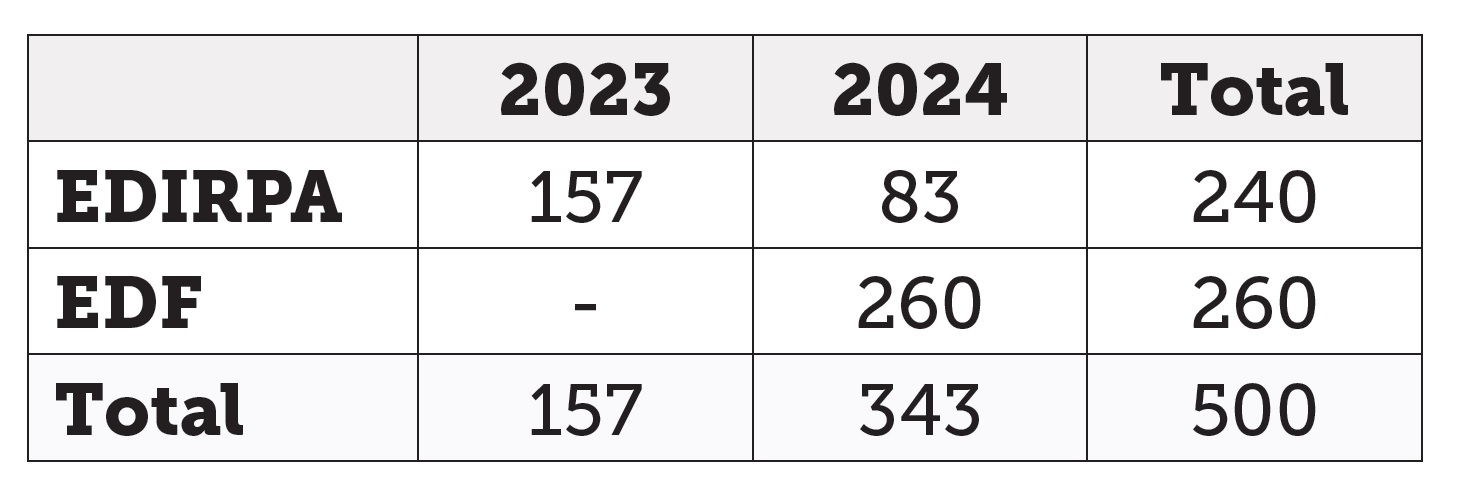

However, it is clear that without an increase in the EU’s resources, every new instrument will require a remodulation of existing defence initiatives. To a certain extent, this has already happened: ASAP will be financed with resources previously allocated to EDIRPA and EDF (Table 2).

Table 2 | Sources of financing of appropriations under the ASAP (millions euro)

Source: European Commission, Proposal for a Regulation on Establishing the Act in Support of Ammunition Production, cit.

Implications for European defence integration

The measures launched by the EU in the wake of the war have a series of implications for the European defence integration process. The emergency measures undertaken after February 2022 are naturally aimed at a very specific task: boosting the output of artillery shells and missiles to replenish depleted stocks and provide long-term sustainable aid to Ukraine. Nevertheless, one should remember that, as mentioned, these policies are essentially aimed at the supply side of the equation and do not contribute to a long-term consolidation of demand. Moreover, ammunitions are far easier to produce than complex weapon systems. As such, a mechanism of reimbursements and targeted financing would not necessarily bring EU defence integration forward when it comes to more advanced systems.

From a demand-side perspective, measures designed to aid Ukraine and increase the production of ammunition do not necessarily help the integration of European defence, on the contrary. Only structured institutional measures that bundle and rationalise European demand for defence goods, such as the development of the European Defence Capability Consortia (EDCC) and full implementation of the recommendations included in the Coordinated Annual Review of Defence (CARD), can lead to structural optimisation of available production capacities.

From a supply-side perspective, delays in the negotiation of EDIRPA also show disagreements between individual member states on the opportunity to keep European defence markets reasonably open to companies from third countries. Indeed, given that weapons systems have, on average, long service time spans, their current acquisition often discourages the procurement of alternative goods due to the complexity of maintaining multiple logistical chains and support systems.[17] While Eastern and Northern member states discount this issue due to the urgency of rapidly rearming, as demonstrated in the European Sky Shield controversy, countries like France and Italy advocate for a long-term approach to improve the competitiveness of the EDTIB and the level of (shared) technological sovereignty over advanced systems. There should be a different approach on one hand for short-term, with short-span initiatives coping with urgent requirements, and on the other hand for long-term and permanent measures. When the latter have to be addressed, it is reasonable that EU financial incentives should benefit the EDTIB.

Squaring the circle requires a robust backing of EDF and EDIP, as they can structurally rationalise the demand side of European defence markets and move the debate beyond a simple question of market access, putting the question of synchronisation and coordination of procurement policies at the centre of European defence affairs.

The limits of the intra-European market

Finally, the achievement of economies of scale also requires a comprehensive re-examination of the 2009 defence market directives,[18] which do not properly address the distortions of the European market structure. On one hand, under directive 2009/81/EC,[19] European cooperative projects are subject to the same competition rules as national or third-country products. This provision has become obsolete since the EU has decided that defence cooperation, both in procurement, research and development, is a priority in its own right. This political choice should be reflected by favouring hardware developed within EU collaborative projects in procurement processes.

On the other hand, directive 2009/43/EC[20] does not enable European defence products to become truly competitive due to heterogeneous and burdensome rules still existing on intra-European transfers, including for IP and immaterial goods. Current rules do not allow for the development of a truly European market when it comes to components, spare parts and subsystems, all of which still need to comply with customs clearings and national certification procedures, thus keeping productive capacities and supply chains fragmented along national borders. Abating such non-tariff barriers should be a priority for the near future.

Michele Nones is Vice President of the Istituto Affari Internazionali (IAI). This commentary is a revised and updated version of a chapter written by the same author for the study Russia-Ukraine War’s Strategic Implications, edited by Alessandro Marrone, Rome, IAI, February 2024.

[1] Kiel Institute for the World Economy, Ukraine Support Tracker, updated on 16 February 2024, https://www.ifw-kiel.de/topics/war-against-ukraine/ukrainesupport-tracker.

[2] Council of the EU website: European Peace Facility, https://europa.eu/!3jNYwR.

[3] Léo Péria-Peigné, “Military Stockpiles: A Life-Insurance Policy in a High-Intensity Conflict?”, in Focus stratégique, No. 113 (December 2022), https://www.ifri.org/en/node/26801.

[4] European Commission website: Act in Support of Ammunition Production (ASAP), https://defence-industry-space.ec.europa.eu/node/453_en.

[5] Sebastian Clapp, “European Defence Industry Reinforcement through Common Procurement Act (EDIRPA)”, in EPRS Briefings, November 2023, https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2023)739294.

[6] European Commission, European Defence Industry: Commission Welcomes Political Agreement on Support for Common Procurement Between Member States, 28 June 2023, https://ec.europa.eu/commission/presscorner/detail/en/ip_23_3554.

[7] Council of the EU, EU Defence Industry: Council and European Parliament Agree on New Rules to Boost Common Procurement, 27 June 2023, https://europa.eu/!7Dr9TN.

[8] Alexandra Brzozowski, “EU Proposes Three-Track Approach to Secure Ammunition for Ukraine, Support Industry”, in Euractiv, 2 March 2023, https://www.euractiv.com/?p=1888130.

[9] By July 2023 donations reached a total of 1 billion euro.

[10] Council of the EU, Delivery and Joint Procurement of Ammunition for Ukraine, 20 March 2023, https://europa.eu/!4jfxJp.

[11] European Commission, Proposal for a Regulation on Establishing the Act in Support of Ammunition Production (COM/2023/237), 3 May 2023, https://eur-lex.europa.eu/legal-content/en/TXT/?uri=celex:52023PC0237.

[12] See Lucas Hellemeier and Michelangelo Freyrie, “Leaving Defenselessness Behind”, in International Politics and Society, 16 June 2023, https://www.ips-journal.eu/topics/european-integration/leaving-defenselessness-behind-6775.

[13] Gaspard Schnitzler, “EDIRPA/EDIP: Risks and Opportunities of Future Joint Procurement Incentives for the European Defence Market”, in Ares Policy Papers, No. 81 (March 2023), https://www.iris-france.org/wp-content/uploads/2023/03/ARES-81-Policy-paper.pdf.

[14] European Commission, Defence: €500 Million and New Measures to Urgently Boost EU Defence Industry Capacities in Ammunition Production, 3 May 2023, https://ec.europa.eu/commission/presscorner/detail/en/ip_23_2569.

[15] Council of the EU, Ammunition for Ukraine: Council Agrees €1 Billion Support under the European Peace Facility, 13 April 2023, https://europa.eu/!grhNB9.

[16] Council of the EU, EU Joint Procurement of Ammunition and Missiles for Ukraine: Council Agrees €1 Billion Support under the European Peace Facility, 5 May 2023, https://europa.eu/!nTfjjD.

[17] Michele Nones, “The Risks to European Defence of Non-coordination”, in Alessandro Marrone et al., The Russia-Ukraine War, Security in Europe and European Defence, Rome, IAI, November 2022, p. 29-32, https://www.iai.it/en/node/16243.

[18] For a deeper analysis, see: Alessandro Marrone and Michele Nones, “The EU Defence Market Directives: Genesis, Implementation and Way Ahead”, in Documenti IAI, No. 20|18 (September 2020), https://www.iai.it/en/node/12156.

[19] European Parliament and Council of the EU, Directive 2009/81/EC of 13 July 2009 on the Coordination of Procedures for the Award of Certain Works Contracts, Supply Contracts and Service Contracts by Contracting Authorities or Entities in the Fields of Defence and Security, http://data.europa.eu/eli/dir/2009/81/oj.

[20] European Parliament and Council of the EU, Directive 2009/43/EC of 6 May 2009 Simplifying Terms and Conditions of Transfers of Defence-related Products within the Community, http://data.europa.eu/eli/dir/2009/43/oj.

-

Details

Rome, IAI, February 2024, 6 p. -

In:

-

Issue

24|08